Why Insurance Agent App?

For features, functionality and value, there’s no comparison!

Your client list is worth a lot of $$$....

That’s why we have not -and will not – reserve the right to “sublicense” (sell) your clients’ data as a competitor has. Retaining control of your data and your client list is the most important reason to work with IA App. Scroll to learn more…

Comparing “Apps”?

Watch the video:

Top 10 Customer Service Platform Considerations

— OR —

Scroll down to:

Top 5 Customer Service Platform Considerations

Top 5 Customer Service Platform Considerations

User Experience

Agency Admins have 100% control over the process to INVITE policyholders to use IA App.

1st-time use:

ALL policy data + Vehicle ID Cards are displayed in-app.

24/7 metrics show when IA App was last opened/used.

Agency-Centric

Primary purpose is to create a personalized experience that facilitates client engagement, service and retention.

IA App keeps the agent at the center-point of the agent-client-carrier relationship.

Other App

Experience

Agency Admins have ZERO control over the process to INVITE policyholders to use their app via email and SMS text. The invite text is also from a # that is different that your business text #. Very confusing for policyholders.

1st-time use:

LIMITED policy data.

Zero Vehicle ID Cards; Policyholders MUST create usernames & passwords for EACH carrier they have policies with to view their Vehicle ID Cards.

The problem with this approach is that policyholders realize that forcing them to establish U/Ps for each carrier makes no sense, so they DO NOT take the extra step(s) to “connect” the app vendor to their carrier(s).

The vendor has TWO metrics to VERIFY:

1: # of App downloads;

2: # of policyholders who take the time to set-up U/Ps with EACH carrier so that ALL policy data – including Vehicle ID Cards – are displayed in their app. HINT: The # is REALLY low!

Carrier-Centric

They position their offering as a prospecting and service tool. There are two problems with this approach:

- Consumers / Prospects DO NOT like being forced to install a mobile app to MAYBE do business with a company.* Positioning ANY mobile app as a prospecting tool is misleading at best, and claiming that organic revenue can be recognized using an insurance app is a flat-out untruth at worst. Prospects will go to an agent’s website to get a quote, but they will not download/install an app for the purpose of starting the quote process.

- Pushing clients to service DIRECTLY with a carrier through a 3rd party app is the fastest way to irrelevancy for a P&C insurance business, and for unnecessary carrier service and claims submission(s).

Agency Admins have 100% control over the process to INVITE policyholders to use IA App.

ALL policy data + Vehicle ID Cards are displayed in-app.

24/7 metrics show when IA App was last opened/used.

Agency-Centric

Primary purpose is to create a personalized experience that facilitates client engagement, service and retention.

IA App keeps the agent at the center-point of the agent-client-carrier relationship.

Other App

Experience

Agency Admins have ZERO control over the process to INVITE policyholders to use their app via email and SMS text. The invite text is also from a # that is different that your business text #. Very confusing for policyholders.

1st-time use:

LIMITED policy data.

Zero Vehicle ID Cards; Policyholders MUST create usernames & passwords for EACH carrier they have policies with to view their Vehicle ID Cards.

The problem with this approach is that policyholders realize that forcing them to establish U/Ps for each carrier makes no sense, so they DO NOT take the extra step(s) to “connect” the app vendor to their carrier(s).

The vendor has TWO metrics to VERIFY:

1: # of App downloads;

2: # of policyholders who take the time to set-up U/Ps with EACH carrier so that ALL policy data – including Vehicle ID Cards – are displayed in their app. HINT: The # is REALLY low!

They position their offering as a prospecting and service tool. There are two problems with this approach:

- Consumers / Prospects DO NOT like being forced to install a mobile app to MAYBE do business with a company.* Positioning ANY mobile app as a prospecting tool is misleading at best, and claiming that organic revenue can be recognized using an insurance app is a flat-out untruth at worst. Prospects will go to an agent’s website to get a quote, but they will not download/install an app for the purpose of starting the quote process.

- Pushing clients to service DIRECTLY with a carrier through a 3rd party app is the fastest way to irrelevancy for a P&C insurance business, and for unnecessary carrier service and claims submission(s).

Features

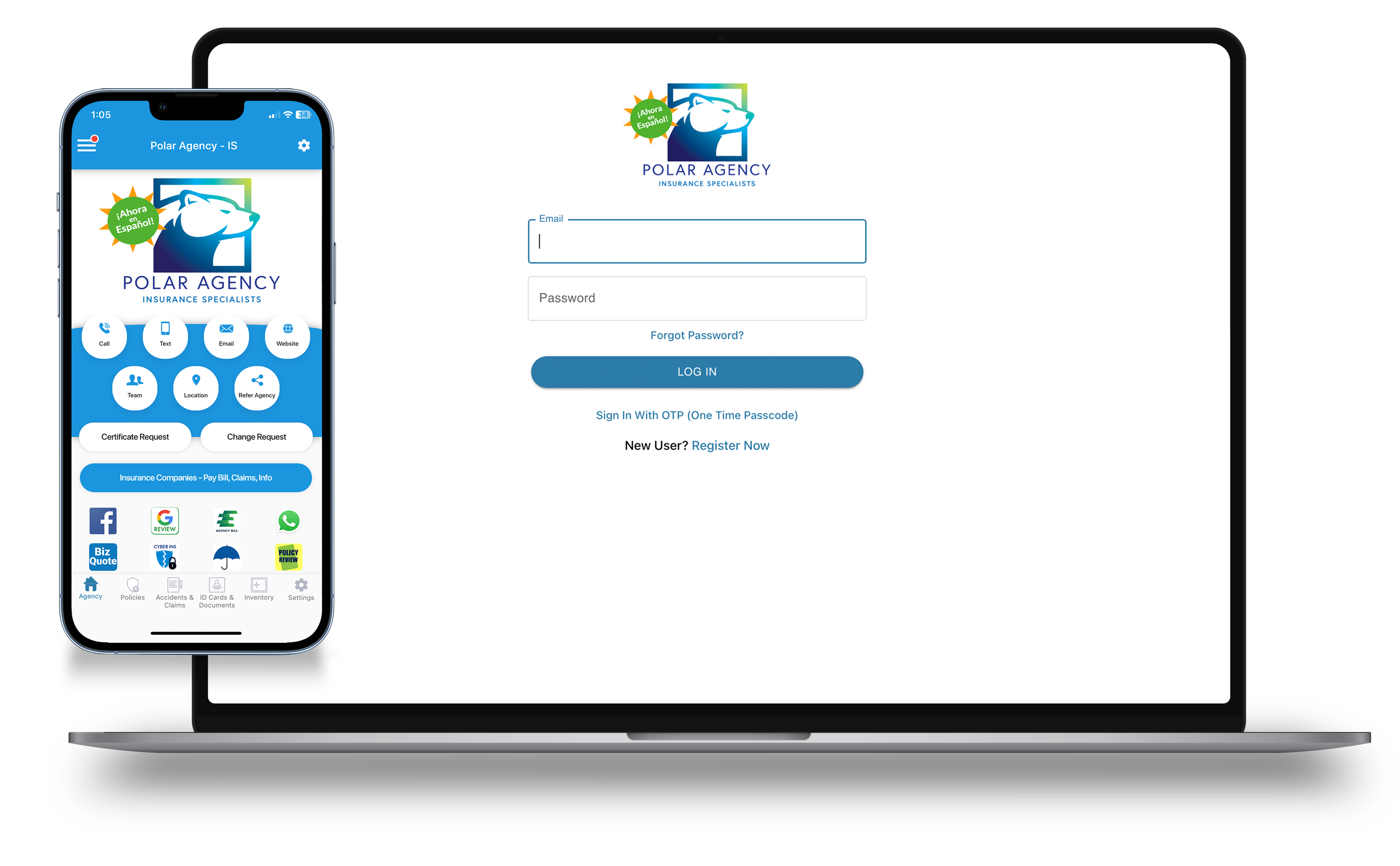

Meaningful features are constantly being incorporated to help policyholders quickly and productively engage with their agent via our mobile app and online client portal.

Meaningful features include:

Claims documentation for Vehicle / Workplace accidents & property incidents;

Asset Inventory;

Biometric Access;

Multi-Lingual Options;

Preferred Icons.

While features are important, IA App gets very high marks for the user interface. Clean and simple so that policyholders can be more productive when dealing with their insurance agent.

Other App

Experience

Limited functionality.

If a policyholder even takes the extra steps to establish usernames and passwords with ALL of their carriers so that policy information + Vehicle ID Cards can be accessed, there is still not much the policyholder can “do” in the other app offering that helps the policyholder be more productive with their agent.

AMS Integrations

Deep integration means that we deliver to policyholders ALL of their PL & CL data. Not just top-level policy-header data, but coverages, limits, deductibles, additional interest etc.

Our integrations offer the most reliable and accurate way to deliver policy data and vehicle ID cards to policyholders – even for non-standard and E&S policies when the data for those policies is entered into an AMS.

When available, IA App writes-back to our AMS partners at either the Policy Level or Client Level so that CSR’s can quickly act upon policyholder change and certificate requests etc.

IA App also maintains their own proprietary database of nearly 1000 insurance companies so that policyholders can connect to their company for bill pay, claims etc. when necessary.

Other App

Experience

Limited Agency Management System (AMS) integrations mean policy data that gets loaded into their offering must be enhanced with carrier data.

Carrier policy data is accessed by:

1. Sanctioned carrier service Application Programming Interfaces (APIs);

2. Accessing carrier consumer web portals with a policyholder’s username & password to scrape data.

Although most carriers have quoting API’s, very few have service APIs for 3rd party vendor use.

That’s why the primary method by which data is accessed for the other app is Option #2 above.

Option #2 is questionable at best, and (from a knowledgeable tech vendor perspective) unreliable at worst because if ANYTHING changes on the carrier portal, the data is not readable until the scraping code is updated to accommodate the carrier’s changes.

It is an unreliable approach to access policy data for consumers, which leads to downstream issues for agents.

Terms of Use/Service

IA App has never reserved the right to sublicense or “sell” either agency or policyholder data, nor will we do so in the future.

We ONLY use data provided by an agency or an agency’s clients to deliver our service.

IA App does not, nor do we reserve the right to, contact or engage with an agency’s clients for marketing purposes.

Other App

Experience

The other app has reserved the right to sublicense (sell) policyholder data if that policyholder uses their app or online client portal.

The other app has reserved the right to contact an insurance agent’s clients at any time, even if the app vendor is no longer working with the policyholder’s agent.

We ONLY use data provided by an agency or an agency’s clients to deliver our service.

Other App

Experience

Value

IA App bases its pricing on the number of an insurance agent’s active clients with active policies.

We make the IA App accessible for all sized P&C insurance agents: From a scratch agent to the largest businesses in the P&C space.

We charge a set-up fee because we produce a lot of high-quality videos, graphics and marketing materials for our client agencies to help them promote the IA App to THEIR clients.

We’ve been told we do not charge-enough for the value we bring to independent P&C agents.

Other App

Experience

The other app has a similar pricing model to IA App, but does not provide any of the marketing assets or support provided by IA App.

Basically, the other app is half the product of IA App at DOUBLE the cost.

We make the IA App accessible for all sized P&C insurance agents: From a scratch agent to the largest businesses in the P&C space.

We charge a set-up fee because we produce a lot of high-quality videos, graphics and marketing materials for our client agencies to help them promote the IA App to THEIR clients.

We’ve been told we do not charge-enough for the value we bring to independent P&C agents.

Other App

Experience

Basically, the other app is half the product of IA App at DOUBLE the cost.