Do you ever feel like there’s just too much stuff in your home? Whether it’s for a pastime, hobby, or general household items – it sometimes can be hard to keep track of all our belongings. Consider this: If something unfortunate were to happen, such as a robbery, house fire, or a natural disaster, are you able to provide your insurance agent with a complete list of all your possessions, with pictures and a value placed on each item?

Chances are the answer is no. In surveys completed after natural disasters, an average of 59% of all claimants did not have a home inventory; an additional 20% have a basic list of possessions listed under high-valued items. Couple this with a highly emotional and stressful time, and you have a recipe for another potential disaster. According to Brasher Law Firm, LLC underpayment of an insurance claim is five to ten percent more common than a claim being denied.

To help make life easier and give yourself some peace of mind amidst the chaos of modern family households – creating a legit home inventory is something that could save you time, energy, and money. If you do not properly document what you own, it is likely that if a claim does arise, you will be paid much less than what they are actually worth.

Not sure how to complete an inventory? Read on as we explain how having a thorough property inventory can benefit you today and the fastest way to create one!

You will know what to insure once you know everything you have.

Purchasing insurance can be daunting; typically, you want the process to be quick and painless. However, to have a productive conversation with your agent and find the best plan, you need to understand what type of coverage you need and how much you need to cover!

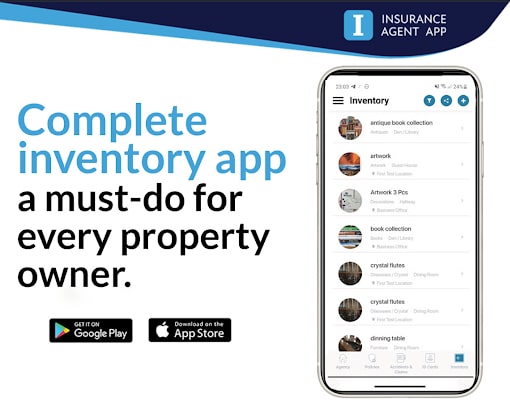

Before discussing any possible insurance plans with your agent, understand what coverage you already have. Consider how much additional coverage may be necessary compared to what you already possess. You can do this by providing an inventory of all your possessions. When speaking with an agency, look for agencies offering their clients a mobile application with an inventory feature – such as the Insurance Agent App – to perform this task quickly and easily. Agencies that have embraced digital technology offer their clients a high level of success in servicing their policies quickly and efficiently.

Prepare for Emergencies in Advance

With an updated inventory of your property and possessions, you’ll be prepared for emergencies in advance and help your insurance agent verify that your assets are properly insured.

Here are a couple of ways to stay on top of a home inventory.

- Whenever you purchase something new, enter it into a mobile application under inventory.

- Each quarter, look to see if you missed anything and quickly add them into a mobile application under inventory. i.e. discovered some items in the attic you forgot you had, a wonderful new gift.

- Before a major storm, double-check and ensure you have everything up to date. Print out a complete inventory list and place it in a sealed plastic bag or keep it in a special folder for non-digital access if the power and internet are out.

It’s important to not only document your valuables but also their current value, so you’re able to properly insure them for replacement or repair.

A mobile app also makes the task of organizing your property more manageable and efficient, including photos, descriptions, serial numbers, purchase dates, and prices when available. The use of a mobile app offers you the ability to have more details and an organized summary of what you own. Once again, look to insurance agencies that provide a mobile app to their clients free of charge.

Performing this inventory ahead of time prevents the hassle of trying to recall what you owned in case your property is damaged by an unforeseen catastrophe. Proactively doing an inventory with a mobile app really pays off if you need to file a claim or use insurance coverage because most insurance companies want proof an item existed before they will cover a claimed item.

File a Claim Quickly

Filing a claim quickly after a disaster is an essential but often stressful task. This is an emotional time for you. To ensure that your insurance company receives the information they need in a timely manner, remember to include all of the possessions that were damaged or lost, as well as documentation such as pictures, receipts and/or contracts.

Keeping track of these vital details can become complicated and stressful during times of chaos, so make sure you have utilized a mobile app’s inventory tool that you can access on multiple platforms. Remember your power, internet, and technology devices may be unavailable. Having a backup or additional means to access your mobile tools will assist you in submitting a claim in which everything is accounted for quickly and easily.

Filing an accurate and timely claim could be the difference between recovering your belongings or not.

Verify Your Loss with the IRS – How to Prove Your Loss for Tax Deduction Purposes

Another way to lighten your burden is to take advantage of deductions that you may qualify for, such as losses from property theft or damages. The only way to verify these losses and claim them on your taxes is by documenting them appropriately with the IRS. Having well-organized records, like an accurate home inventory, makes claiming these deductions infinitely easier. Not only do good records help speed up the process, but it also ensures that you receive the right amount of deduction when filing your taxes. So if there has been a significant loss in the past year, make sure you document it properly with the IRS to reap the full benefits!

With this knowledge, you can be well prepared to find the right insurance policy and rest easy knowing that any potential losses can be adequately covered. Tools agencies offer you should help determine the right partner to manage your risks. Make sure to take the time now to start researching insurance agencies and their mobile tools to select the right fit for your needs, then complete the inventory process- you’ll be glad you did!