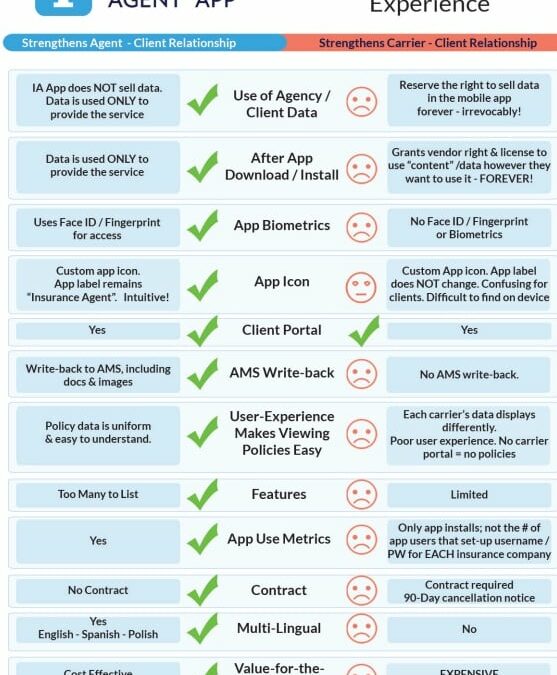

In today’s digital age, mobile apps have become essential tools for businesses across all industries. From banking to shopping, these apps streamline processes and enhance user experiences. However, not all mobile apps are created equal. When it comes to serving the needs of insurance agents and their clients, flexibility is key. That’s where Insurance Agent App (IA App) stands out, offering a suite of features designed to cater to the diverse needs of both agents and policyholders. Here are just a few perks of IA App!

Biometrics for Easy Login:

Gone are the days of remembering numerous passwords. IA App incorporates biometric authentication, allowing users to log in seamlessly with their fingerprints or facial recognition. This not only enhances security but also simplifies the user experience, making it effortless for clients to access their accounts.

AMS Write Back for Automatic Documentation:

Time is precious, especially for insurance agents. With Agency Management Systems (AMS) Write Back functionality, IA App automates documentation processes, saving agents valuable time and reducing the risk of errors. This feature ensures that client information is always up-to-date and accurately recorded. Insurance Agent App has integration with HawkSoft, NowCerts and QQCatalyst. Call us to discuss the levels of writeback you can enjoy with the difference AMS systems.

Metrics Availability:

IA App provides real-time metrics on various aspects of app usage, including install rates, carrier connection rates, and app last used/accessed data. These metrics offer valuable insights into client engagement and help agents make informed decisions to improve user experiences.

Multi Language Interfaces:

In today’s multicultural world, language barriers can pose a challenge for businesses. IA App addresses this by offering multi language app interfaces, including English, Spanish, and Polish. This ensures that clients from diverse backgrounds can access and navigate the app with ease, fostering inclusivity and expanding the reach of your services.

Great App Reliability:

IA App is built on a solid foundation, ensuring exceptional reliability and performance. With robust architecture and rigorous testing, clients can rely on the app to deliver a seamless experience every time.

UX Uniformity:

IA App maintains uniformity in user experience across different carriers, eliminating the need for clients to navigate through multiple carrier interfaces to find information or pay bills. This consistency streamlines the user journey, enhancing satisfaction and loyalty.

No Mandatory Contracts, Month-to-Month:

IA App offers flexibility in billing with no mandatory contracts. Clients have the freedom to opt for a month-to-month subscription, giving them greater control over their expenses and ensuring they only pay for what they need.

In conclusion, not all mobile apps are created equal, especially when it comes to meeting the unique requirements of insurance agents and their clients. IA App stands out with its flexible features, including biometrics for easy login, AMS Write Back for automatic documentation, metrics availability, multi language support, great app reliability, UX uniformity, and no mandatory contracts. With IA App, insurance agents can elevate their service offerings and provide clients with a seamless and personalized experience.

More information: https://insuranceagentapp.com/why-insurance-agent-app/